How does a 401k work?

- Nov 24, 2024

- 2 min read

Updated: May 1, 2025

Having worked with public and private corporations for almost 50 years, we understand our clients' need and how to help them understand and benefit from the plans that are available.

One of those plans is the 401k. Throughout the years of helping employees, we have found that most don’t understand how a 401k works or how to use one for their retirement.

While many people include a 401(k) in their retirement planning, a lack of education—both from salespeople and participants—often leads to confusion and misunderstandings about how these plans actually work.

Here’s an illustration that shows the difference in a paycheck with and without a 401(k).

Paycheck Example

Without a 401k

After the IRS takes its 20% ($20) and you save $10 in a credit union, bank or other kind of after-tax (deduction) savings account, you have $70 left over to pay bills, etc.

Paycheck Example

With a 401k

(10% of Gross)

By moving your $10 after-tax savings into a pre-tax 401k, your taxable income drops to $90. Taxes go from $20 to $18, and with $10 in your 401k, your take-home pay INCREASES by $2.

Paycheck Example

With a 401k Increase

Increasing your 401k contribution to $12.50 lowers your adjusted gross income to $87.50. With taxes at $17.50, your take-home pay stays at $70, even though you're SAVING MORE.

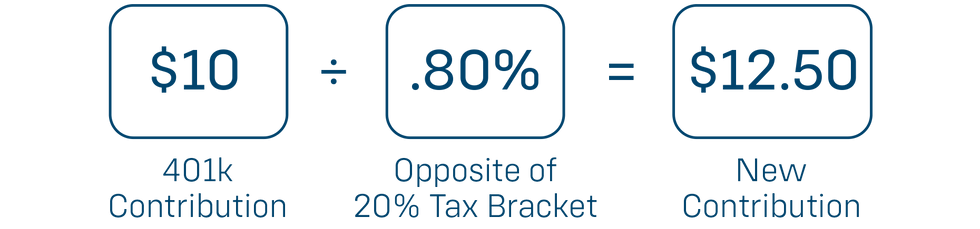

Pre-Tax Contributions Formula

In the above example, how would you know the $12.50 pre-tax 401k contribution would equal the same take home pay?

Here’s a formula for figuring pre-tax contributions.

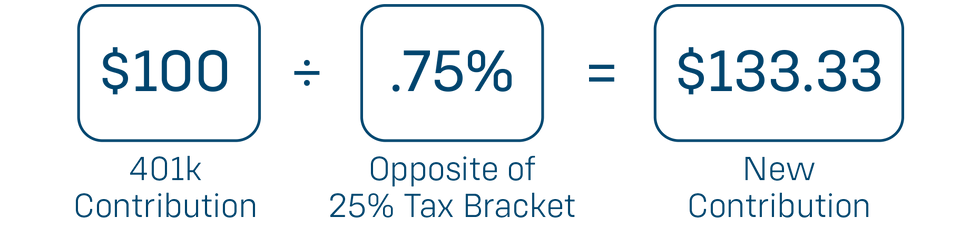

Let’s Take it One Step Further!

What if you were in the 25% tax bracket and the amount of the contribution was $100?

If you saved $1,200/year, which would you rather have?

The 401k over the bank (or credit union) creates a 33% greater return*, plus any additional interest that might be in your particular 401k plan.

*Actual returns may vary depending on how the 401k is invested. Rates could be higher or lower.

For your personal illustration, reach out to an Advisor.

Comments